Introduction

Retirement planning has become increasingly complex in today’s financial landscape. With the decline of traditional final salary schemes, money purchase pensions have become the norm in the private sector. However, many individuals fail to comprehend the fundamental disparities between these two pension models.

It is crucial to recognise that money purchase pensions necessitate active involvement, decision-making, and responsibility from scheme members. In this article, we will delve into the aspects that people often overlook when it comes to money purchase pensions, emphasising the need for informed choices and realistic expectations.

The Shift from Final Salary to Money Purchase Pensions

Historically, many workers were enrolled in final salary schemes, also known as defined benefit pensions, which provided a guaranteed income linked to their final salary upon retirement. In such schemes, the employer bore the investment and longevity risks. However, due to economic pressures and increasing life expectancies, these schemes have become less common due to the costs of employer funding, with money purchase pensions taking their place.

Money Purchase Pensions: Member Responsibility and Investment Decisions

Unlike final salary schemes, money purchase pensions are individual accounts where contributions are invested to accumulate a retirement fund. The pension income is determined by the accumulated pot’s performance, rather than being a fixed proportion of the final salary. This shift places significant responsibility on the scheme member to make informed investment decisions and manage contributions to achieve personal retirement targets.

Varying Values and Projected Incomes

One key aspect often misunderstood about money purchase pensions is the variability in the value of the pension pot over time and they do not automatically generate a target income at retirement. Contributions are invested in a range of assets such as stocks, bonds, and property, which can fluctuate in value.

Periodic valuations are provided with projected incomes based on regulatory guidelines, however these are estimates based on assumed investment returns. The actual pension outcome can deviate from these projections due to factors such as market volatility, contribution levels and economic conditions.

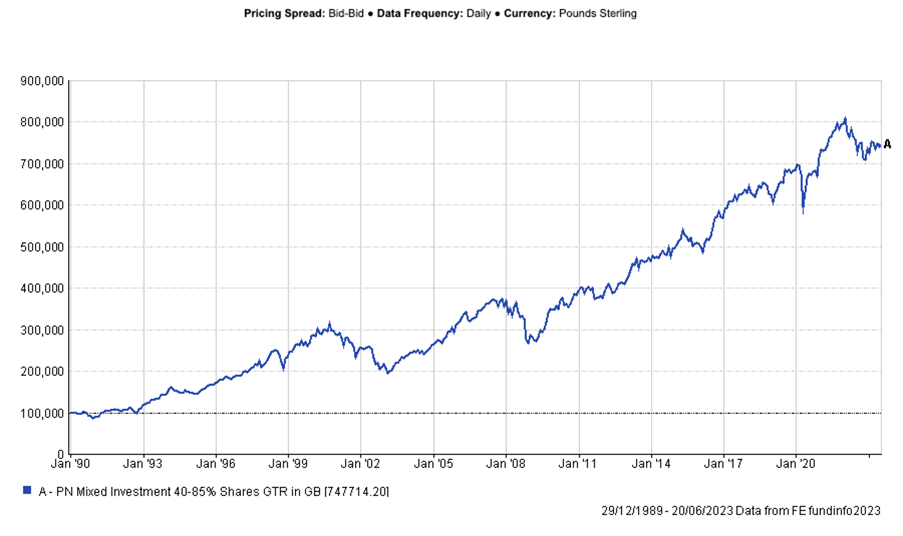

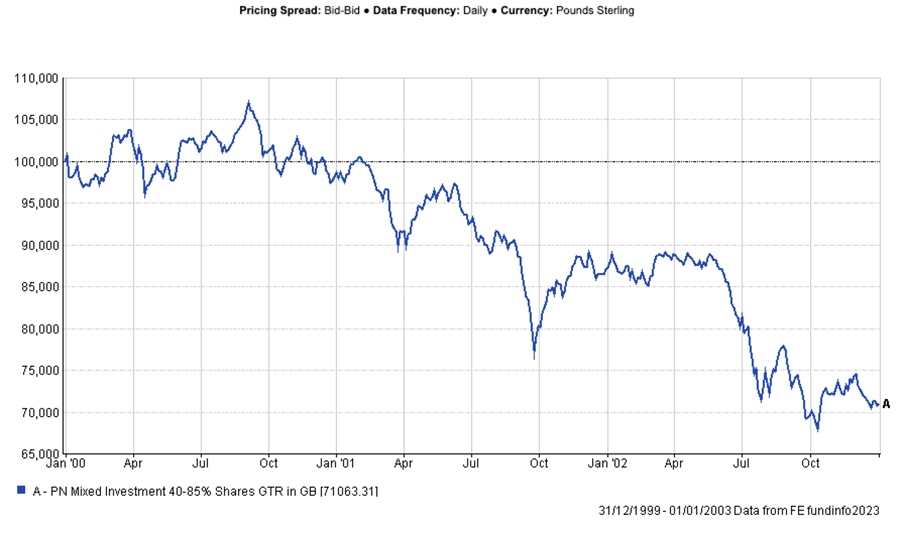

As highlighted in diagram 1 (below), compounding over a longer time period allows investors to traverse periods of market volatility and decline, as shown in diagram 2 below. Understanding and appropriately dealing with the elements investors can control (timeframe, contributions, investment choice, charges) obviates the temptation to try to control elements out of investors control (market returns) which still distract many investors today.

Diagram 1: Money Purchase Pension Fund Example Value Over Time

Diagram 2: Early 2000s market decline

Please note past performance is not a guide to future returns. Investments can go down as well as up and you may get back less than you invest.

Projected Income vs. Reality

Unlike final salary schemes, money purchase pensions do not automatically generate a pension income. In some cases, there may be special annuity rate conditions attached but these are becoming fewer in number.

At the point of drawing benefits, the accumulated fund must be ‘converted’ to income or the member may choose to take capital withdrawals. Unlike a defined benefit pension, the underlying resource is finite. Withdraw too much and the fund will erode to zero, so an understanding of safe withdrawal rates and structuring retirement income is critical.

Importance of Informed Decision-Making

To navigate the complexities of money purchase pensions successfully, individuals must actively engage in decision-making. Factors such as investment choices, contribution levels, and retirement age all significantly impact the ultimate pension outcome. Seeking professional financial advice becomes crucial in understanding risk profiles, asset allocation, and establishing realistic targets tailored to personal circumstances.

Risks and Uncertainties

Money purchase pensions also expose scheme members to various risks. Market volatility, interest rate fluctuations, and inflation can all impact the value of the pension pot. Unlike final salary schemes, where the employer bore these risks, money purchase pension holders must face them themselves.

Conclusion

Money purchase pensions offer individuals greater flexibility and control over their retirement savings, but they come with significantly increased responsibility, risk and cost to the member. Understanding the distinctions between final salary schemes and money purchase pensions is essential for making informed decisions and setting realistic retirement expectations.

The variable nature of pension fund values and the potential discrepancies between projected incomes and reality highlight the importance of active engagement, carefully monitored investment choices, appropriate contribution levels and seeking professional advice.

By developing a clear understanding of the following elements,

- Timeframe

- Contribution level

- Target fund value required based on well-reasoned assumptions

- Ensuring good value in overall costs

and

- That you cannot control investment returns

….members are more likely to develop successful ‘money purchase’ retirement solutions.